The Minister of Information stated that the Houthi militia operates parallel financial networks for money laundering and funding terrorism.

Houthi Militias Create Parallel Financial Networks for Money Laundering

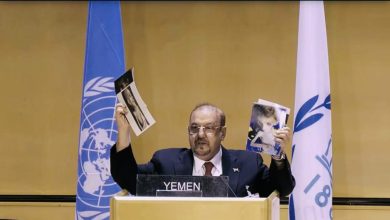

Minister’s Statement on Houthi Financial Operations

Yemeni Minister of Information, Culture, and Tourism, Muammar Al-Eryani, has accused the Iran-aligned Houthi militia of establishing parallel financial networks. These networks serve as a covert arm of the militia’s economy, facilitating money laundering and the legitimization of illicit revenue. Al-Eryani emphasized that these operations allow the militia to secure funding while evading international scrutiny.

Impact on the National Economy

Al-Eryani highlighted that the secretive structure of Houthi financial networks has become a central tool for empowering the militia and undermining the national economy. He noted that these networks provide a cover for smuggling and recycling funds to support Iran’s agenda in the region.

Systematic Control of Financial Sector

Since their takeover, the Houthis have systematically targeted Yemen’s financial and banking sectors. They began by looting the Central Bank in Sana’a, seizing cash reserves and commercial bank deposits. Furthermore, they have obstructed supply operations to the Central Bank of Yemen in Aden.

Violations Against Currency Exchange Companies

The minister pointed out that the militia has committed widespread violations against currency exchange companies in areas under their control. These actions include forced closures and strict regulations, aimed at paving the way for alternative exchange companies loyal to the militia. These companies have been integrated into a financial network focused on money laundering.

Secret Financial Network Management

According to a report from the Yemen Organized Crime and Money Laundering Tracking Platform (P.T.O.C), the Houthis have established a secret financial network managed by ten leaders from their so-called “Security and Intelligence Agency.” This network operates under direct supervision from the militia’s leader, controlling the economy and evading international sanctions. It invests in various vital sectors, including oil, real estate, pharmaceuticals, telecommunications, and foreign trade.

Estimated Annual Cash Flows

Al-Eryani stated that Houthi financial networks handle annual cash flows exceeding $2.5 billion. This figure includes looted funds from the banking sector, illegal taxes, and revenues from illicit activities such as black markets and drug trafficking. Additionally, profits from businesses established by the militia serve as both domestic and foreign fronts.

Revenue from Currency Exchange Companies

The “Regain Yemen” report documented that the Houthis received over 528 million Yemeni riyals from just five currency exchange companies in 2022. This suggests that they could be collecting around 10 billion riyals annually from 100 exchange companies, equivalent to approximately $20 million, excluding profits from affiliated businesses and indirect revenues.

Total Assets in Currency Exchange Sector

The same report indicates that currency exchange companies hold assets totaling 4.15 trillion riyals, including 2.15 trillion in local currency and 2 trillion in foreign currencies, amounting to about $3.7 billion.

Concerns Over Illicit Transfers

Al-Eryani warned that these networks facilitate illegal internal money transfers and suspicious remittances to countries such as Iran, Lebanon, Syria, and Iraq. They also enable the purchase of real estate and assets under the names of loyal intermediaries, serving as significant tools for money laundering and terrorism financing.

Consequences for the National Economy

These activities have led to catastrophic consequences for Yemen’s economy. They have eroded public trust in the banking system, facilitated capital flight, imposed parallel exchange rates, and manipulated cash liquidity. Consequently, these actions have weakened monetary policy and diminished the Central Bank’s control over the market.

Call to Action Against Houthi Financial Networks

Al-Eryani concluded by asserting that combating the Houthi militia requires more than military action. It necessitates pursuing their financial networks, cutting off funding sources, and imposing sanctions on the currency exchange companies they have established. He emphasized that these networks represent a cornerstone for financing the Houthi war and Iran’s agenda, as well as a gateway for funding terrorist activities targeting Yemen and the broader region.

To follow the news in Arabic