On Thursday, the Central Bank of Yemen’s Board of Directors concluded its tenth session via video conference, led by Governor Ahmed Ghaleb. The meeting focused on recent developments in the financial and monetary sectors, alongside key indicators and their forecasts. These discussions come amid challenging conditions for the Yemeni economy, primarily due to the halt of crucial resources and a significant decline in external support.

Addressing Economic Challenges

The board explored various strategies to tackle these pressing economic issues. They tasked the executive management with reaching out to the Presidential Leadership Council and the government. This communication aims to inform them about the current situation, emphasizing the urgent need for action to alleviate existing bottlenecks. The board highlighted the critical importance of addressing salary and service disruptions, as well as the complications these issues pose for the Central Bank’s operations.

Institutional Reforms and Capacity Building

In addition to economic challenges, the board also addressed several important matters related to institutional reforms within the bank. They discussed initiatives to enhance capacity building and modernize automated systems and payment frameworks, with the support of international organizations and friendly nations. Furthermore, the board underscored the importance of improving governance and transparency. They plan to complete audits of the bank’s past budgets and publish all relevant data across the bank’s official channels, ensuring adherence to best practices in banking management.

The Central Bank of Yemen’s proactive approach to addressing financial developments and institutional reforms demonstrates its commitment to stabilizing the economy. By collaborating with governmental bodies and enhancing operational transparency, the bank aims to navigate the current economic landscape effectively.

To follow the news in Arabic

Prime Minister meets with the Assistant Secretary-General of the United Nations.

Prime Minister meets with the Assistant Secretary-General of the United Nations. Houthi escalation leads to a new massacre in the rural areas of Taiz.

Houthi escalation leads to a new massacre in the rural areas of Taiz. The Deputy Governor of the Central Bank discusses recent developments with a European delegation.

The Deputy Governor of the Central Bank discusses recent developments with a European delegation. The meteorological authority warns Yemen of scattered rains and a light to moderate cooling wave.

The meteorological authority warns Yemen of scattered rains and a light to moderate cooling wave. The Minister of Public Works discusses road project implementation in Yemen with the UNOPS project director.

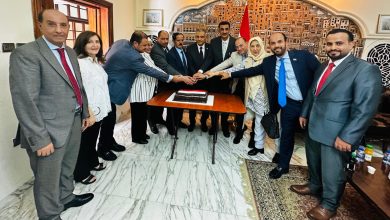

The Minister of Public Works discusses road project implementation in Yemen with the UNOPS project director. Our embassy in Jordan celebrates the 30th anniversary of national independence on November 30th.

Our embassy in Jordan celebrates the 30th anniversary of national independence on November 30th.