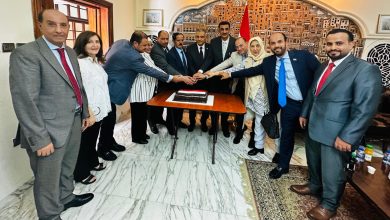

On Tuesday, Dr. Mohammed Omar Banajeh, the Deputy Governor of the Central Bank of Yemen, met with a delegation of European Union ambassadors in the temporary capital of Aden. The discussion focused on the latest developments in Yemen’s financial and economic situation.

Overview of Yemen’s Financial Crisis

During the meeting, Dr. Banajeh outlined the reasons behind the worsening financial crises in Yemen. He highlighted the severe fluctuations in exchange rates, which stem from the country’s deteriorating economic conditions. These challenges have directly impacted the banking and financial sectors. Since the Houthi militia’s attacks on oil export facilities in October 2022, Yemen has experienced a significant halt in oil exports. This decline has severely affected the state’s foreign currency revenue, exacerbating the budget deficit and the balance of payments crisis.

Impact of Houthi Attacks on International Trade

Dr. Banajeh also addressed the consequences of Houthi assaults on international shipping. These attacks have led to increased payment obligations, further straining Yemen’s economy. He reassured the ambassadors that the Central Bank is actively working to overcome these challenges by utilizing available monetary policy tools.

Continued Support from the European Union

In response, the EU ambassadors reaffirmed their commitment to supporting Yemen. They emphasized ongoing humanitarian assistance and the importance of strengthening the Central Bank’s capabilities. The ambassadors expressed their support for enhancing financial inclusion and improving systems to combat money laundering and the financing of terrorism.

The meeting underscored the urgent need for international cooperation to address Yemen’s economic difficulties and ensure stability in the region.

To follow the news in Arabic

Prime Minister meets with the Assistant Secretary-General of the United Nations.

Prime Minister meets with the Assistant Secretary-General of the United Nations. Houthi escalation leads to a new massacre in the rural areas of Taiz.

Houthi escalation leads to a new massacre in the rural areas of Taiz. The meteorological authority warns Yemen of scattered rains and a light to moderate cooling wave.

The meteorological authority warns Yemen of scattered rains and a light to moderate cooling wave. The Minister of Public Works discusses road project implementation in Yemen with the UNOPS project director.

The Minister of Public Works discusses road project implementation in Yemen with the UNOPS project director. Our embassy in Jordan celebrates the 30th anniversary of national independence on November 30th.

Our embassy in Jordan celebrates the 30th anniversary of national independence on November 30th. The Minister of Planning discusses ongoing project portfolio in Yemen with the World Bank.

The Minister of Planning discusses ongoing project portfolio in Yemen with the World Bank.