The Central Bank discusses measures for establishing an instant payment company and restructuring the unified network.

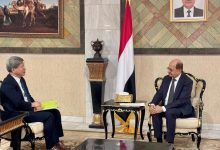

Central Bank of Yemen Discusses Banking Measures in Aden

A meeting held today in Aden, the temporary capital of Yemen, focused on key banking procedures. The session, led by Central Bank Governor Ahmed Ghaleb, included representatives from various banks.

Establishing Fast Payment Company

During the meeting, participants discussed the establishment of the Fast Payment Company. This initiative aims to enhance the banking sector’s role in facilitating transactions. The company will accelerate and simplify banking operations, which are essential for implementing a digital payments and settlements system in Yemen. The World Bank supports this initiative, highlighting its significance for the country’s financial landscape.

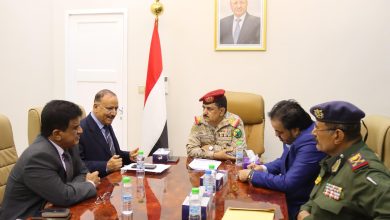

Restructuring the Unified Network Company

The meeting also addressed the restructuring of the Unified Network Company. Attendees, including Deputy Governor Dr. Mohammed Banajeh and banking sector regulators, emphasized increasing the company’s capital. They proposed that banks should hold a larger share of the network and suggested transferring management of the network to the banks. This change would expand the network’s functions and operational scope.

Strengthening Compliance Measures

Additionally, the discussion included enhancing compliance measures for banks and exchange companies. This step aims to facilitate international transactions between Yemen and the global community. The urgency of this matter has increased, especially following the designation of Houthi militias as a terrorist organization by the United States and other countries.

The meeting represents a significant step toward improving Yemen’s banking infrastructure and ensuring smoother financial interactions both domestically and internationally.

To follow the news in Arabic