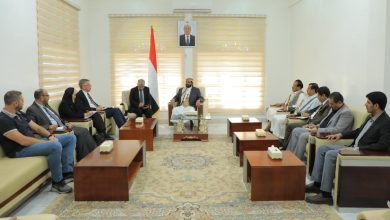

On Tuesday, October 8, 2023, Ahmed Lamlas, the Minister of State and Governor of Aden, convened a meeting with Jamal Sarour, the Head of the Tax Authority. The discussion focused on improving tax collection processes in Aden, the temporary capital of Yemen.

Positive Outcomes and Challenges

The meeting included key officials, such as Abdul Hakim Muin, Director of the Tax Office in Aden, Mustafa Al-Shaari from the Finance Office, and directors from various districts and tax branches. Participants highlighted the positive results achieved through the recent integration of networked tax collection systems. However, they also addressed several challenges that hinder operational efficiency and explored potential solutions to overcome these obstacles.

Key Decisions Made

As a result of the discussions, several important decisions emerged:

- Office Location Policy: Authorities will prohibit the rental of any tax office premises in the districts. Instead, they will allocate government buildings for this purpose.

- Contract Processing: The meeting emphasized the need to expedite the acceptance of contracts within the networked system while adhering to established regulations and guidelines.

- Staff Redistribution: To address staff shortages, officials agreed to redistribute personnel based on the specific needs of each district.

Regular Coordination Meetings

The meeting concluded with a commitment to hold regular coordination meetings between the Revenue Center, the Tax Office, and its branches in the districts. These meetings will occur in collaboration with district directors. Additionally, participants decided to implement a monthly reporting system to monitor strengths and weaknesses in the tax collection process.

This proactive approach aims to streamline tax collection in Aden, ultimately enhancing the region’s financial stability. The collaboration between various governmental bodies signals a commitment to overcoming challenges and improving public service efficiency.

To follow the news in Arabic

Al-Aradah discusses military and security developments with the UN envoy’s military advisor and their impact on the peace process.

Al-Aradah discusses military and security developments with the UN envoy’s military advisor and their impact on the peace process. Tariq Saleh discusses the latest developments with the UAE ambassador.

Tariq Saleh discusses the latest developments with the UAE ambassador. Mareb officials and the Technical Education Authority launch the furnishing of the Community College, funded by Kuwait.

Mareb officials and the Technical Education Authority launch the furnishing of the Community College, funded by Kuwait. Workshop on violence against girls concludes in Aden, focusing on awareness and prevention strategies.

Workshop on violence against girls concludes in Aden, focusing on awareness and prevention strategies. Training customs personnel in Qatar on monitoring strategic goods.

Training customs personnel in Qatar on monitoring strategic goods. Al-Thuqali discusses efforts to document the Socotri language and directs preparations for the heavy vehicles site at the port.

Al-Thuqali discusses efforts to document the Socotri language and directs preparations for the heavy vehicles site at the port.