Central Bank Governor Issues Closure Orders for Two Exchange Companies

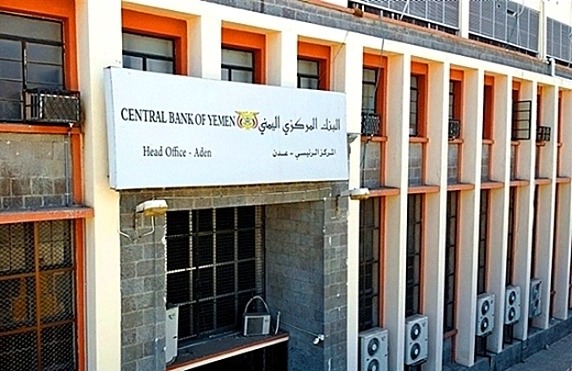

In a significant regulatory move, Ahmed Ghaleb, the Governor of the Central Bank, announced today the issuance of two key decisions aimed at maintaining financial integrity within the currency exchange sector.

License Revocation for Al-Haqaf Exchange

The first decision, numbered 20 for the year 2025, mandates the revocation of the license granted to the Al-Haqaf Exchange branch in Ataq. Additionally, the decision includes the immediate closure of the branch’s premises. This action underscores the Central Bank’s commitment to enforcing compliance among financial institutions.

Suspension of Ridan Exchange License

In a related action, the Governor issued decision number 21 for 2025, which suspends the license of Ridan Exchange. Similar to the previous decision, this order also requires the closure of the company’s location.

Reasons Behind the Decisions

Both decisions stem from findings reported by the Banking Supervision Sector. A recent field report indicated that both Al-Haqaf and Ridan Exchange had violated regulatory standards. The Central Bank’s proactive measures aim to uphold the integrity of the financial system and protect consumers.

These actions reflect the Central Bank’s ongoing efforts to ensure compliance and maintain stability in the currency exchange market. As regulatory scrutiny intensifies, stakeholders in the financial sector are urged to adhere to established guidelines to avoid similar repercussions.

For more updates on financial regulations and market developments, stay tuned to our coverage.

To follow the news in Arabic